Havoc for U.S. Stocks

Uber goes public, Lyft and Uber stocks fall, and Trump imposes tariffs — the past week has been all but steady, and it has all been focused around Friday’s financial flop.

May 12, 2019

On Friday, Uber, valued at $82.4 billion, released its initial public offering (IPO). It initially started trading at $45 per share, but pessimistic investors drove the price down by over 7%. At the time that markets closed on Friday, Uber traded at a mere $41.57. Concerning the fundamentals of the company, its revenue last year increased by an astounding 42%, yet they still have no reported earnings. In fact, over the 10-year course of the company’s existence, it has had a net loss of about $9 billion. One reason that this ride-hailing company may be under scrutiny is due to the strike that their drivers have organized to combat the low wages. Uber globally employs just under 4 million drivers.

Uber’s disappointing market performance also follows the March IPO of its greatest rival: Lyft. Lyft (initially valued at $24.3 billion) went public in March at $78.29 per share, but has since plummeted by roughly 35%. It is now being traded at about $51 per share, dropping an entire 18% last week alone. Lyft’s fall in market price last week can be attributed to a conglomerate of factors. Foremost, the markets as a collective have been volatile this past week, and this has been in part due to the Trade War.

Trade War

On Friday, Trump made an effort at protecting U.S. industry and jobs by discouraging the importation of Chinese goods. He upscaled tariffs from 10% to 25% on about $200 billion worth of Chinese exports to the United States. In 2018, the U.S. trade deficit to China reached $419 billion (i.e. the difference in the value of our exports to China and China’s exports to the U.S.), and Trump plans to reduce this by implementing these tariffs. According to the United States International Trade Commission, among the $200 billion of goods to be furthered taxed include $19.1 billion worth of telecommunications equipment and $12.5 billion in circuit boards for computers.

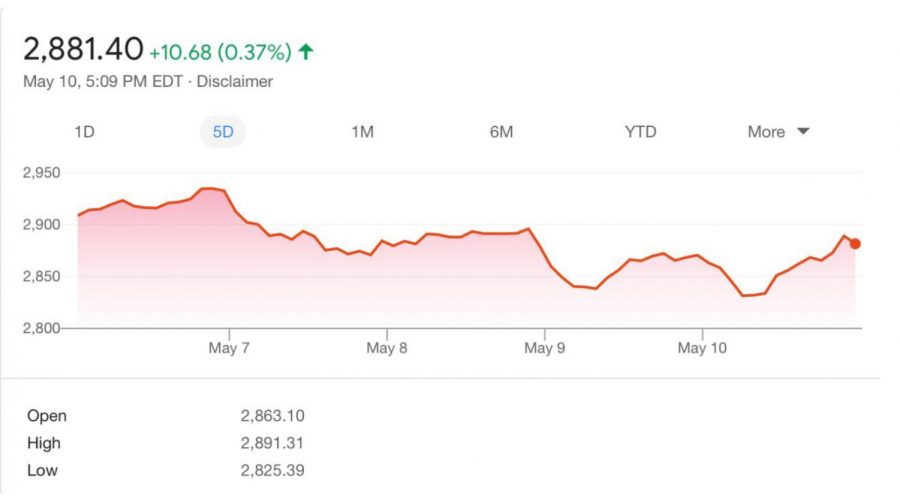

The effect of this trade war on the U.S. stock market was negative. Many investors shorted and sold stocks, with the Dow Jones Industrial Average dropping by about 223 points (or $223) and the S&P 500 following a similar trend, eventually dropping 32 points. Both indices slightly rebounded, but ultimately, as a recession is predicted to hit hard sometime over the next 5 years, this week is evidence that nothing is predictable.